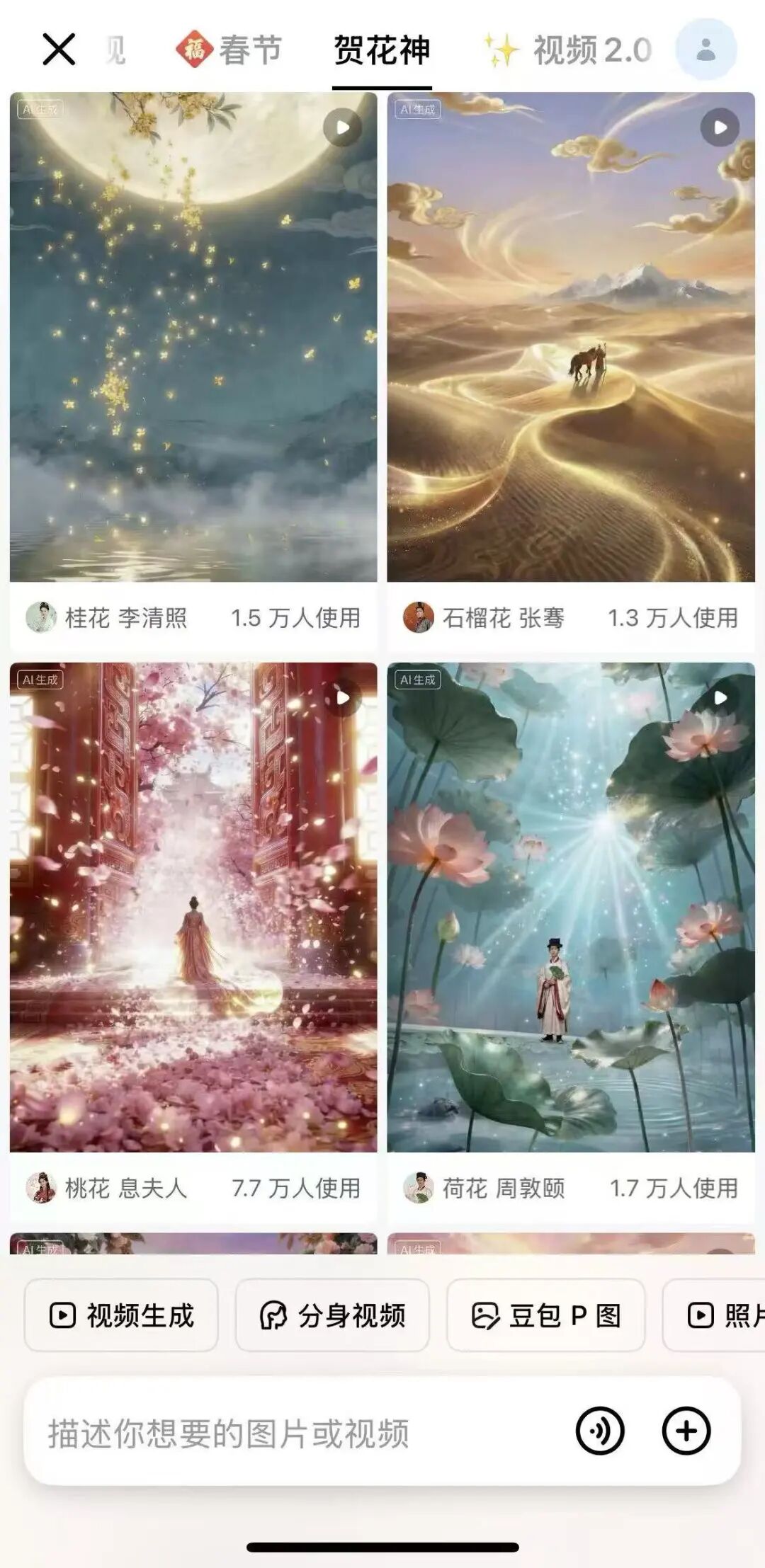

Chinese giants invest over 45B RMB in AI voice payment subsidies during 2026 Spring Festival to seize user intents via agents. ByteDance's Doubao AI phone was blocked by rivals' ecosystems, while Alibaba's Qwen thrives in closed-loop integration across its services.

Key Points

- 1.Giants' 45B subsidies exceed past wars, pushing voice-activated AI payments.

- 2.Doubao phone blocked by WeChat logins, Ali apps, banks for crossing ecosystems.

- 3.Qwen handles 1.2B orders in 6 days via Alibaba-internal agent orchestration.

- 4.AI shifts competition from app time to intent capture and decision proxy.

Impact Analysis

Intensifies AI agent ecosystem battles; closed super-apps like Alibaba gain edge over cross-platform plays, reshaping commerce via intent pricing.

Technical Details

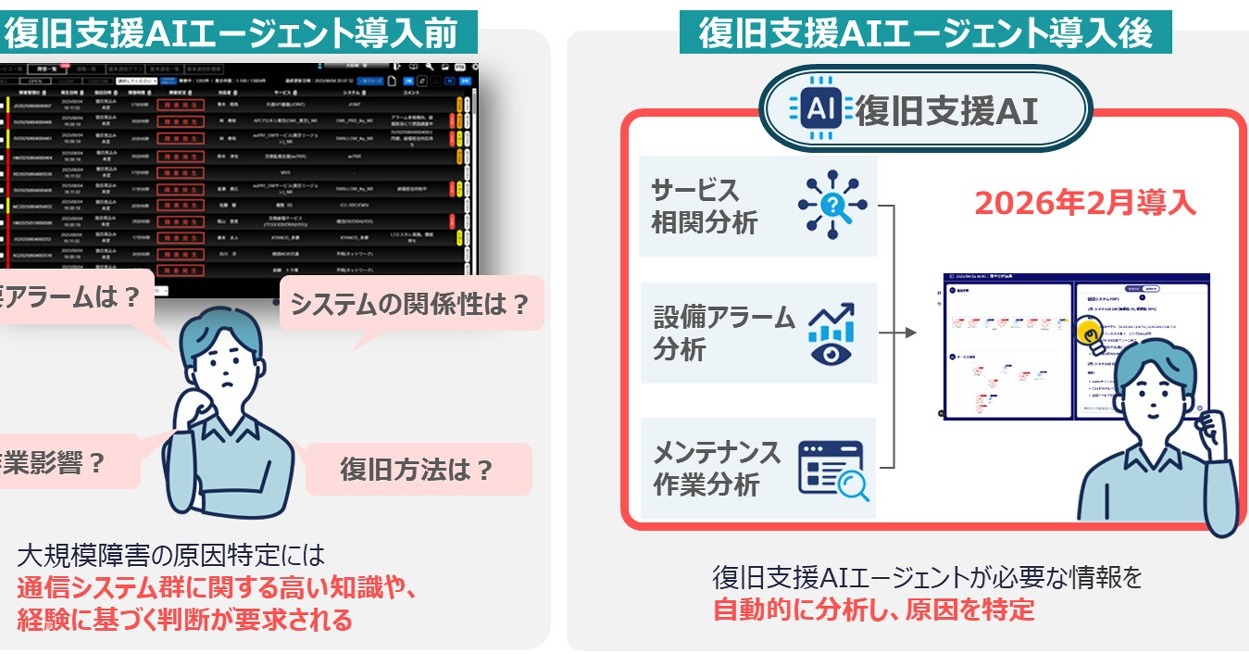

AI agents automate full transaction flows (search, select, pay) via voice intents, reducing steps to zero; Qwen uses Alibaba's unified model-ecosystem combo.