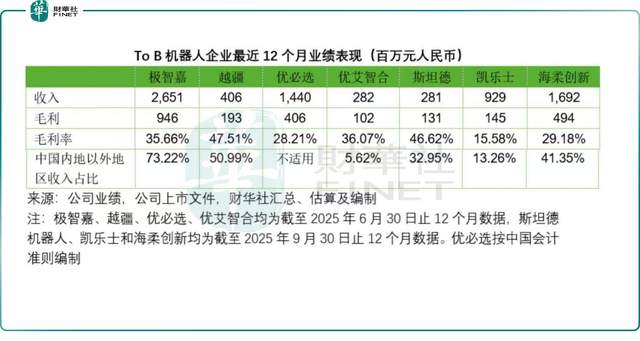

Robot industry remains in investment-heavy phase based on 2025 H1 financials. Differentiation among companies is increasingly evident. Investors assess which firms show strongest profit potential.

Key Points

- 1.2025 H1 financials show industry-wide 'investment > returns'

- 2.Clear differentiation emerging among robot companies

- 3.Shift from tech demos to profitability focus

- 4.Spotlights promising firms in competitive landscape

Impact Analysis

Signals robotics maturation, aiding AI founders in identifying viable embodied AI investments amid funding shifts.